The Philippine president’s ambitious $167 billion plan to build up infrastructure for long-term job creation and economic development will tap into his new friendship with China for funding, despite doubts at home.

President Rodrigo Duterte said his “golden age” of infrastructure would create roads, railways and other public infrastructure through the end of his term in 2022. The Southeast Asian country, where about one-fifth of people live in poverty, has missed factory investment, and with it job creation, partly because of a lack of those amenities.

Roads, railways and ports

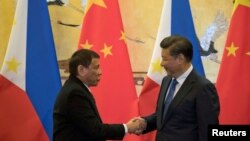

China has offered the Philippines up to $24 billion in aid that includes such projects, part of a friendship that the two former rivals began pursuing after Duterte took office in June 2016. Previously China and the Philippines angrily disputed tracts of the South China Sea. Beijing had taken an upper hand with land reclamation in the sea’s Spratly Islands and coast guard patrols over a shoal coveted by Filipino fishermen.

“It shouldn’t be a surprise that the Philippines would be receiving more funding,” said Song Seng Wun, Southeast Asia-specialized economist with the private banking unit of CIMB in Singapore.

“The only thing, obviously all these things will come with a catch,” he said. “In the case of the Philippines, from the Chinese, it’s to get the Philippines on their side as far as the South China Sea claims over territory are concerned. It does anchor the Philippines closer toward the Chinese.”

The Philippines wants to be more economically competitive

A heftier infrastructure budget, which began growing in 2016 under Duterte’s predecessor Benigno Aquino, would build new ground transportation as well as expand ports and airports for use by foreign-invested factories. Investors now pick places such as China and Vietnam because of their more developed facilities.

“We are ready to fund the Build, Build, Build infrastructure program that will ensure robust growth for the economy and more inclusive growth pattern and dramatic reduction in poverty incidence by 2022,” presidential office spokesman Ernesto Abella said via the office website July 6.

At least 20 million Filipinos are “poor,” according to the Philippine Statistics Office Authority data last year. They live on less than half the “living wage,” of 1,088 pesos ($24.10) per day, it said via the presidential website.

The Philippines is also raising money through tax reform to fund new infrastructure. From July to May, the government collected about 2.09 trillion pesos ($41 billion) in revenues, seven percent higher than in the same period a year earlier, Abella said.

But officials are also tapping China. Over the past year, for example, Beijing has discussed helping fund two Philippine railway projects with a combined total cost of $8.3 billion. China agreed in January to work with the Philippines on 30 projects and put up the equivalent of $3.7 billion.

But who benefits the most?

Philippine pundits and opposition politicians have questioned that funding because they worry Beijing would use it to erode their country’s sovereignty claim to the fishing-rich, oil-laden South China Sea off their west coasts.

Some also wonder whether China will send its own workers and materials for the projects it funds. Chinese-funded projects in other countries have come with Chinese labor, meaning fewer local jobs.

“We want to know if these infrastructure projects that will be funded by loans from China will really translate into actually jobs for skilled and unskilled laborers, for fellow Filipinos, as well as local sourcing of materials for the big push for infrastructure by the administration,” said Georgina Hernandez, spokeswoman for separately elected Philippine Vice President Leni Robedo.

Philippine Senator Leila de Lima asked the senate in May to examine any proposed loan from China that would rack up debt or compromise Philippine sovereignty.

Distrust, but is it warranted?

Most Filipinos distrust China, according to a survey by Metro Manila research organization Social Weather Stations in the first quarter of 2017.

But the Philippines will probably find China’s loan terms equal to what private banks would offer according to Christian de Guzman, vice president and senior credit officer with Moody’s in Singapore.

Beijing has made similar offers across Eurasia under its 4-year-old “Belt-and-Road” initiative aimed at increasing Chinese influence while picking up contracts for Chinese firms.

“The debate, with regards to borrowing from China I think, has some political overtones to it,” de Guzman said.

“But I think from a pure financial perspective, the cost of borrowing from China is not any cheaper or any more expensive than borrowing from the market,” he said. “This is because borrowing from China is typically done through the Chinese policy banks. They’re not a private bank. They’re state owned.”

China is using its financial clout

Brunei, Malaysia, and Vietnam also contest Beijing’s claims to the 3.5 million-square-kilometer South China Sea. They resent Chinese control of islets for military use as well as its passage of coast guard vessels through waters overlapping their own claims.

China has turned to its $11.2 trillion economy to offer investment for all three, keeping their anger quiet especially after a world arbitration court ruled a year ago this month against the legal basis for much of Beijing's maritime claims.